Master the Art of Budgeting to Accelerate Debt Payoff 🎯

Struggling with debt and searching for a way out? Effective budgeting can be your secret weapon in accelerating debt payoff. By strategically managing your finances, you can take control of your money and fast-track your journey to a debt-free life. Let’s explore some practical tips to help you budget wisely and eliminate your debt faster.

1. Track Your Expenses:

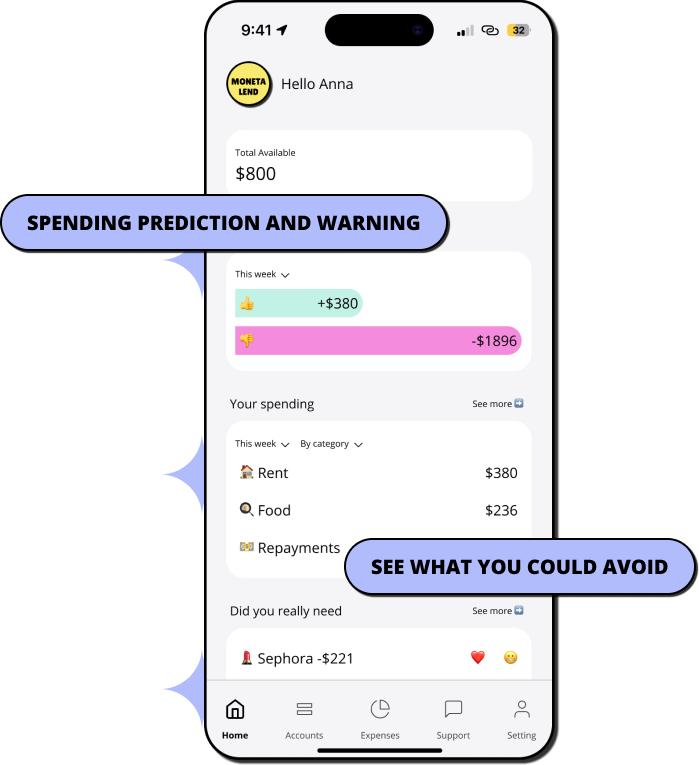

Understanding where your money goes is the first step to better budgeting. Start by tracking every expense for a month. Use budgeting apps, spreadsheets, or a simple pen and paper to categorise your spending. This visibility will help you identify areas where you can cut back and allocate more funds to your debt repayment.

2. Create a Realistic Budget:

Once you’ve tracked your expenses, create a budget that aligns with your financial goals. Prioritise your debt payments by allocating a significant portion of your income towards them. Ensure your budget is realistic and sustainable, allowing for necessary expenses and a little buffer for unexpected costs.

3. Prioritise High-Interest Debts:

Tackle your high-interest debts first to reduce the amount of interest you pay over time. This strategy, known as the avalanche method, focuses on paying off debts with the highest interest rates while making minimum payments on others. By eliminating these debts, you’ll save money and expedite your journey to becoming debt-free.

4. Cut Unnecessary Expenses:

Review your spending habits and identify areas where you can cut back. Consider cancelling unused subscriptions, eating out less, or finding cheaper alternatives for everyday expenses. Redirect the money you save towards your debt payments to speed up the process.

5. Set Achievable Goals:

Set clear, achievable goals for your debt repayment journey. Break down your debt into manageable chunks and set milestones to celebrate along the way. These small victories will keep you motivated and focused on your ultimate goal of financial freedom.

6. Increase Your Income:

Look for opportunities to boost your income and accelerate your debt payoff. Consider side hustles, freelance work, or selling unused items. Every extra dollar you earn can go directly towards reducing your debt, helping you achieve your goals faster.

7. Stay Disciplined and Consistent:

Consistency is key to successful budgeting and debt repayment. Stick to your budget, avoid unnecessary expenses, and stay committed to your financial goals. Remember, every sacrifice you make now brings you closer to a debt-free future.

Conclusion:

Budgeting is a powerful tool in your journey to pay off debt quickly. By tracking your expenses, creating a realistic budget, prioritising high-interest debts, cutting unnecessary expenses, setting achievable goals, increasing your income, and staying disciplined, you can accelerate your debt payoff and pave the way to financial freedom. Start implementing these tips today and take control of your financial future!

Ditch Debt with Our Smart Loans! 💸

📉 Lower rates

💵 Free financial advising

🌱 Healthier habits

💸 $2K-50K loans

Pay off your credit card debt and learn how to stay debt-free.