Financial Mistakes to Avoid in Your 20s and 30s 🎯

Your 20s and 30s are a critical time for building a strong financial foundation. Avoiding common financial pitfalls during these decades can set you up for long-term success. Here are some financial mistakes to watch out for

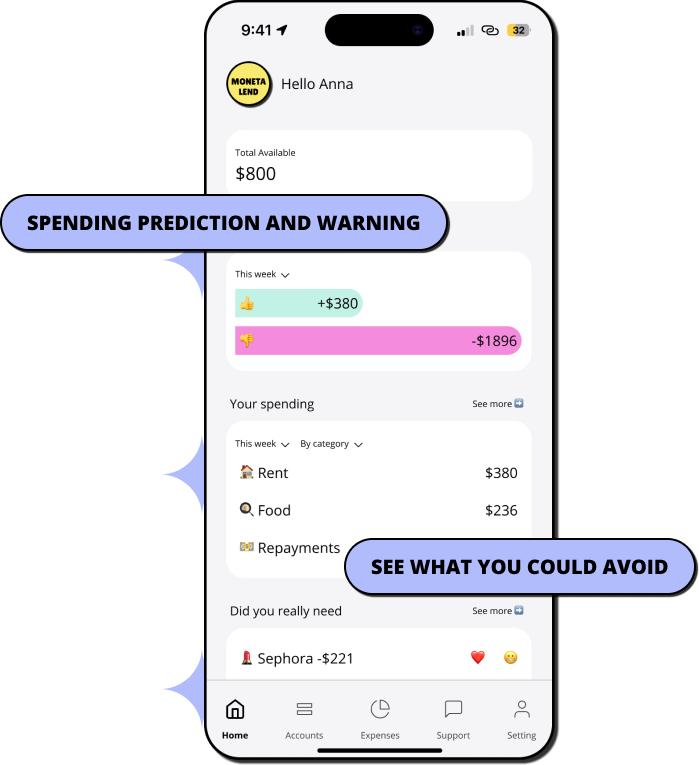

Not Having a Budget: A budget is your financial roadmap, helping you allocate your income towards expenses, savings, and investments. Without a budget, you risk overspending and missing out on opportunities to grow your wealth. Create a budget and stick to it to maintain financial discipline.

Neglecting Savings and Investments: Saving for an emergency fund and investing for retirement are crucial steps in securing your financial future. Take advantage of compound interest by starting early and consistently contributing to your savings and investment accounts.

Over-Reliance on Credit Cards: Credit cards can be a convenient tool, but relying on them for everyday expenses can lead to mounting debt. Use credit cards responsibly by paying off the balance in full each month to avoid interest charges and maintain a healthy credit score.

Postponing Debt Repayment: Procrastinating on debt repayment can lead to higher interest costs and longer repayment periods. Prioritize paying off high-interest debts, such as student loans and credit card balances, to reduce your financial burden.

Avoiding Insurance Coverage: Insurance provides a safety net in the event of unforeseen circumstances. Ensure you have adequate coverage for health, auto, and home or renters insurance to protect yourself from financial setbacks.

Lifestyle Inflation: As your income grows, it’s tempting to upgrade your lifestyle. However, increasing your expenses in tandem with your earnings can hinder your ability to save and invest. Practice mindful spending and live below your means to maximise your financial potential.

Ignoring Investment Opportunities: Investing is a powerful way to grow your wealth over time. Educate yourself on different investment options, such as stocks, bonds, and real estate, and begin investing as soon as possible to capitalise on long-term growth.

By steering clear of these financial missteps and embracing sound financial practices, you can lay a solid foundation for a prosperous future. Prioritise budgeting, saving, and investing to navigate your 20s and 30s with confidence and financial security.

Ditch Debt with Our Smart Loans! 💸

📉 Lower rates

💵 Free financial advising

🌱 Healthier habits

💸 $2K-50K loans

Pay off your credit card debt and learn how to stay debt-free.